The results of the market study do not indicate any significant change in the competitive situation in the hotel accommodation distribution sector in the EU compared to 2016.

Executive summary

Objective of the study: This study provides the European Commission (Directorate-General for Competition) with up-to-date facts on the distribution of hotel accommodation in the EU, including on any changes that have occurred since the Monitoring Exercise conducted by the European Competition Network in this sector in 2016, as well as any changes resulting from national laws prohibiting the use of parity clauses by hotel booking platforms.

The study focuses on the following research questions:

- How is hotel accommodation distributed in the EU Member States covered by the study?

- Do distribution arrangements differ between these EU Member States? If so, what are the reasons for such differences?

- Have hotel distribution arrangements changed relative to the findings of the Monitoring Exercise carried out in 2016 by the European Competition Network (ECN)? If so, what are the reasons for such changes?

- Has the adoption of laws prohibiting hotel booking platform parity clauses led to changes in distribution arrangements in the Member States concerned?

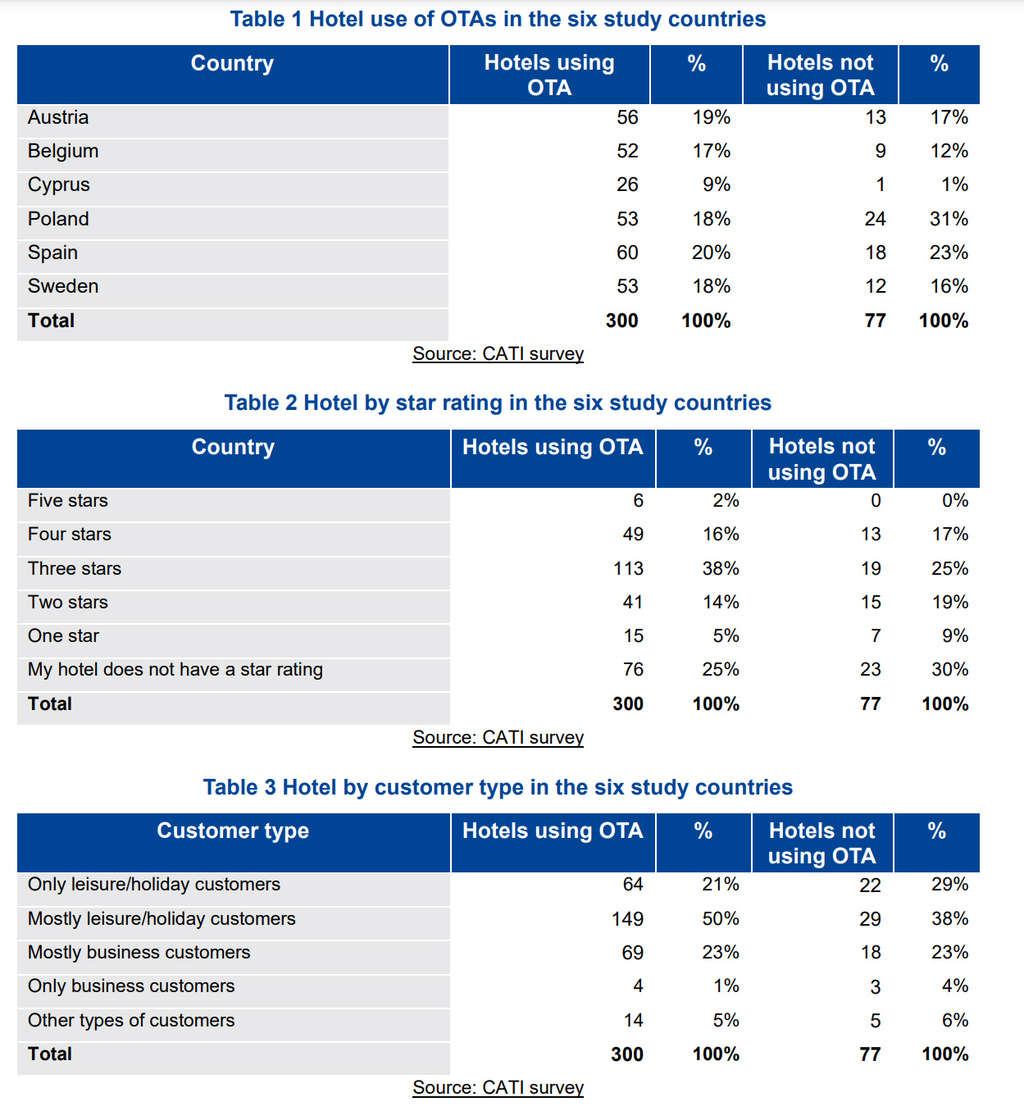

The study covers six EU Member States, namely Austria, Belgium, Cyprus, Poland, Spain and Sweden over the period January 2017 to May 2021 inclusive. It focuses on the sales and marketing practices of the following categories of stakeholders: independent hotels, hotel chains, Online Travel Agents (‘OTAs’) and metasearch/price comparison websites.

Main features of hotel distribution

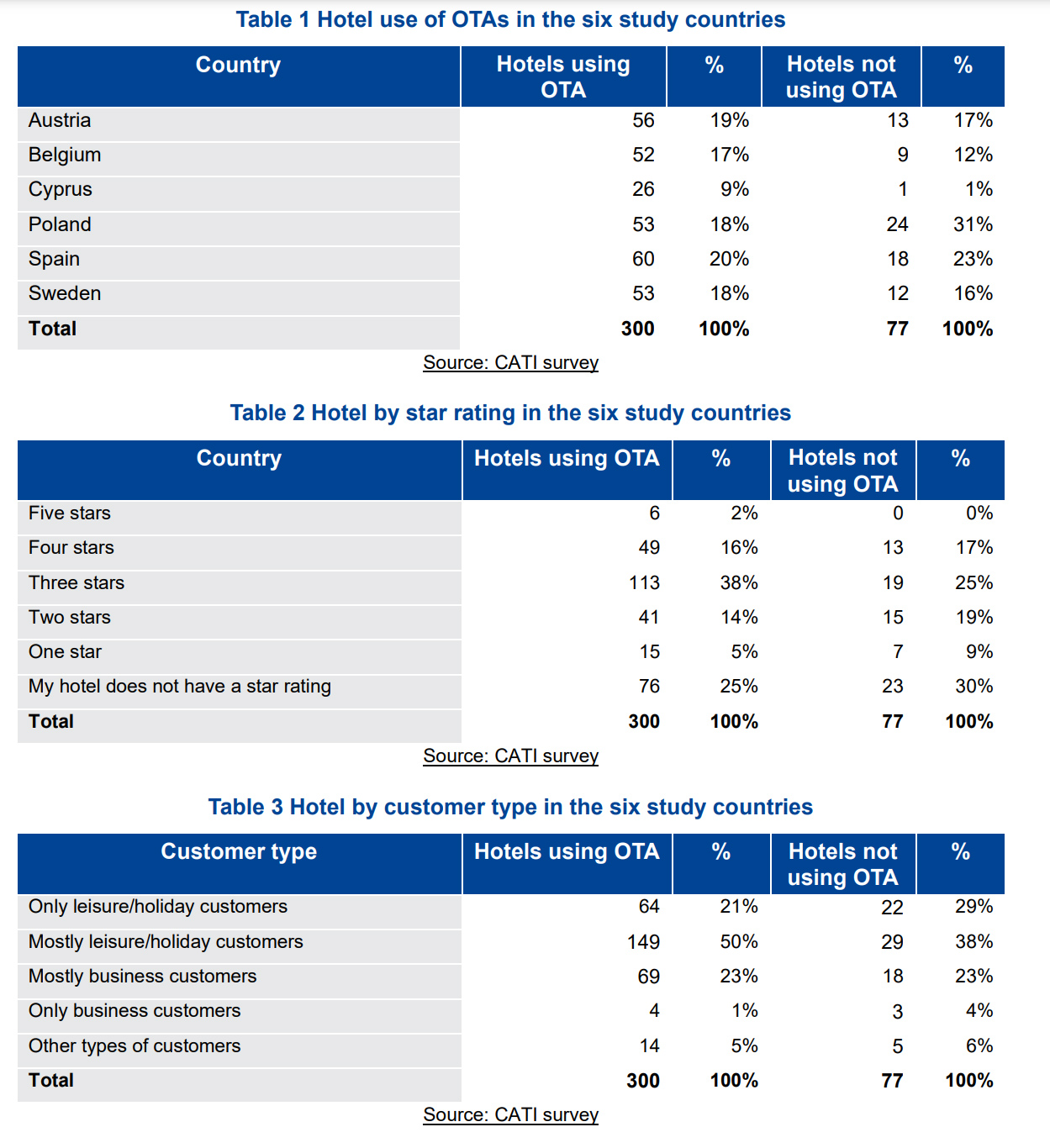

Hotels sell their accommodation through online and offline channels, which can be further divided into direct channels (hotel website, telephone and walk-in) and indirect channels (OTAs, brick and mortar travel agents, bed wholesalers). There are significant differences between independent hotels and hotel chains as regards how they distribute their accommodation.

Use of OTAs by independent hotels

While direct bookings (online and offline) still account for the highest share of independent hotels’ sales (48%), OTAs account for 44% of sales. Micro and small hotels (measured by the number of employees) make a higher share of their sales through OTAs than mediumsized hotels. The majority of independent hotels (72%) use more than one OTA. The four main OTAs used by independent hotels in the six study countries are Booking.com, Expedia, HRS and Airbnb.

A large majority of independent hotels (80%) consider that using OTAs increases their total volume of bookings. Moreover, 63% of independent hotels consider that using OTAs also increases the volume of bookings on their direct sales channels.