- Year-on-year energy consumption has dropped across most sectors

- Healthcare sector shows highest energy consumption and joint-highest CO2 emissions across Europe

- Hotels only sector to see increase in energy consumption year-on-year

Deepki, the only company in the world offering a fully populated ESG data intelligence platform for the commercial real estate sector, has today released the latest findings of its annual “ESG Index“. This publication marks a year since the launch of the Index, which represents the first publicly available European benchmark measuring real estate’s environmental performance using real data. Following its initial publication in late 2022, it was positively received by the market, which was desperately lacking a common framework in order to tackle the challenges brought about by tightening regulations, such as the SFDR. The Index gives values for the average, top performing 30% and top performing 15% in terms of energy consumption and CO2eq emissions for different typologies across the real estate sector in the UK, France, Germany, Benelux, Italy and Spain, as well as Europe as a whole, thereby defining which investments are sustainable according to the EU Taxonomy.

In order to redirect investment flow in line with the 2050 net zero target, the European Commission has detailed certain performance criteria in the EU Taxonomy. According to these criteria, buildings in the top 15% of the national or regional building stock in terms of primary energy intensity will be considered sustainable investments and serve as a benchmark for the entire sector.

The newly published Index shows that the evolution of Europe’s commercial real estate sector’s ESG performance varies from year to year depending on the typology, with housing, offices, healthcare and retail seeing a drop in final* energy consumption, in contrast to hotels, which have increased, while logistics remains stable.

Of the five sectors analysed across Europe, the hotel sector was the only one to see an increase in terms of final energy consumption. This can be attributed to a rise in occupation, as the hospitality industry recovers from the impact of Covid-19, reflecting an evolution in terms of usage not necessarily tied to energy efficiency. Luxury hotels are the main culprits, due to the nature of the services offered. This means owners must find new, less energy-intensive solutions to maintain the same level of comfort. Achieving carbon neutrality requires a multi-faceted approach: improving energy efficiency, and transitioning toward greener energy sources. In contrast, the updated ESG Index shows that the logistics sector has the lowest energy consumption across Europe.

In terms of carbon emissions, the hotel and healthcare sectors rank the highest across Europe, at 39 kgCO₂eq/m² each. Both sectors must step up efforts if we are to limit global warming to 1.5°C and avoid the very worst effects of climate change.

In general, the United Kingdom’s climate contributes to relatively high energy consumption, while its gas-based energy mix results in higher carbon emissions. As in other countries, the UK’s hotels have seen the largest increase in energy consumption (9%) compared to other typologies, mainly due to the sector’s recovery. This is in contrast to the country’s retail sector, which has seen a drop in consumption of 13%, from 250 kWhFE/m² to 217 kWhFE/m² year-on-year. Energy consumption across the housing sector also fell by 10%. Office buildings demonstrate similar consumption to housing, at 216 kWhFE/m². The sector with the highest consumption and carbon emissions was healthcare (299kWhFE/m² and 56 kgCO2eq/m² respectively), with medical facilities requiring a greater amount of energy by the very nature of their activities. While these evolutions may be in part attributed to energy-saving efforts within different sectors, we must also bear in mind the impact of the climate itself, with milder winters contributing to a reduction in energy consumption.

Deepki’s ESG Index provides owners and managers of property portfolios with a unique vision of the sector’s environmental impact, and a reference against which they can measure their own assets’ performance. Progress is being made but it needs to accelerate if we are to halt the devastating impact of climate change and protect asset value. Vincent Bryant, CEO and co-founder of Deepki

Our annual ESG Index represents the latest milestone in Deepki’s mission to achieve a more sustainable future for the real estate sector. As the only publication of its kind, we hope the Index provides clarity and empowers the European real estate industry to take the steps necessary to achieve its net zero goals. Emmanuel Blanchet, COO and co-founder of Deepki

If the industry is to meet its ambitious – but necessary – objective of achieving net zero carbon by 2050, informed decision-making is key. The building sector has a responsibility to take action to tackle climate change, and must come together in doing so. The ESG Index is a perfect example of a collaborative effort to create a reference that can be used by all, for the benefit of all. We are pleased to support this initiative and look forward to seeing how it evolves in coming years. Seema Issar, In-Use Buildings & Sustainable Finance Manager at The German Sustainable Building Council (DGNB)

Christian de Kerangal, Managing Director of IEIF, adds: “As a partner of the ESG Index since its publication, IEIF is convinced of the importance of establishing a common reference for the real estate industry, which must adhere to an increasing number of regulations, including SFDR, if it is to meet its objective of reaching net zero by 2050. In just twelve months, both the Index and the industry have evolved, and we are now able to track these evolving trends. The ability to compare behaviour year-on-year is vital for players to ensure they are heading in the right direction – both individually and as a sector.”

Sander Scheurwater, Head of Public Affairs, Americas, Europe, Middle East & Africa (AEMEA) at RICS, states: “At RICS, we believe in the need for cross-border transparency and consistency in measurement as a foundation for a more resilient, sustainable and inclusive built environment. Industry standards are a key component, and the ESG Index of Deepki is one of the great examples. One year onwards, we are pleased to see that Deepki is continuing to update its index for an industry which is subject to increased regulation in the field of ESG, and therefore requires an increasing amount of guidance and information.”

Methodology

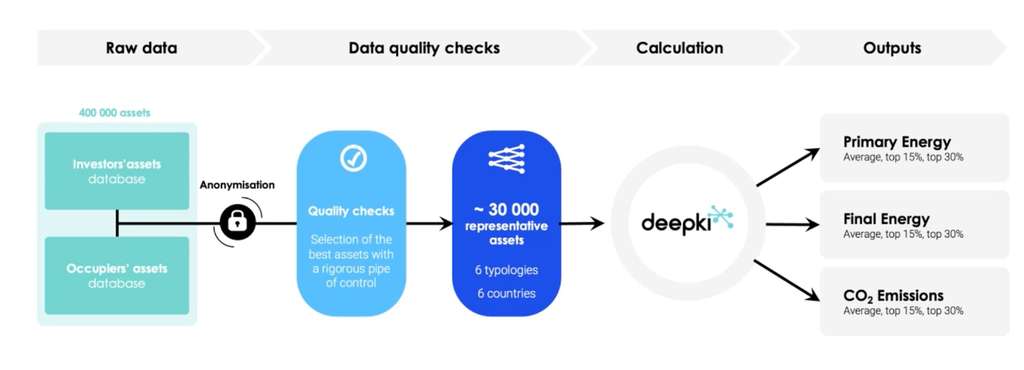

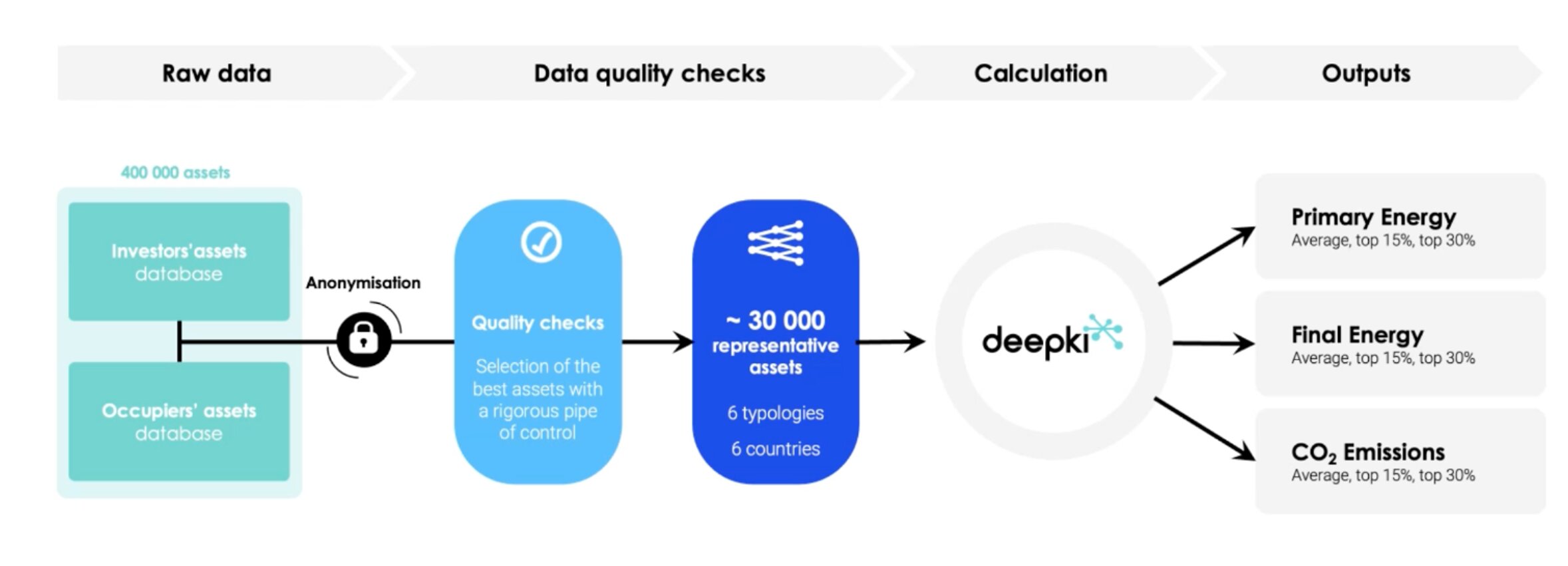

By automatically collecting actual – rather than declarative – data from more than 400,000 assets, Deepki can share in-depth insights into the real estate sector’s energy performance, by asset type and location. Data from over 60 types of buildings is rigorously checked by Deepki’s in-house data scientists, to ensure the most accurate results for the six typologies published.

With values for the top 15%, the market can identify the assets contributing to a reduction in climate change according to the EU Taxonomy. The top 30% will allow the market to determine which assets contribute substantially to the EU Taxonomy’s objectives and do no significant harm in the fight against climate change.

The ESG Index serves as a benchmark for assessing the energy and carbon performance of commercial properties. It provides a reference for the performance of buildings within Asset Managers’ portfolios.

The ESG Index bases its results on a continuous study on data analysed from 2022 and 2021. The benchmark is updated annually and represents a true reflection of the European market and its systemic evolutions, with historic results being updated with each release, to take into account new, previously unavailable data.

*Final energy consumption: Final or available energy is the energy delivered to consumers for end consumption (petrol at the pump, electricity in the household, etc.).

** Primary energy consumption: Primary energy includes all energy products not transformed, directly exploited or imported. It mainly includes crude oil, oil shale, natural gas, solid mineral fuels, biomass, solar radiation, hydraulic energy, wind energy, geothermic energy and the energy taken from uranium fission.

Source: www.insee.fr

ESG Index partners

The ESG Index was established in partnership with the IEIF (Institut de l’Epargne Immobiliere et Fonciere), to help real estate players understand the performance of their assets and meet the challenges of the EU Taxonomy. It is now recognized at a European level thanks to backing from the German Sustainable Building Council (DGNB) and the Royal Institution of Chartered Surveyors (RICS), both of whom support the establishment of a common standard. It represents the first European benchmark measuring real estate’s ESG performance based on real consumption data.

About Deepki

Founded in 2014, Deepki has developed a SaaS solution that uses data intelligence to guide real estate players in their net zero transition. The solution leverages customer data to improve assets’ ESG (Environmental, Social and Governance) performance and maximize asset value. Deepki operates in 52 countries, with over 400 team members across offices in Paris, London, Berlin, Milan and Madrid. The company serves clients including Generali Real Estate, SwissLife Asset Managers and the French government, helping to make their real estate assets more sustainable at scale.

In March 2022 Deepki raised €150 million in a Series C funding round which was jointly led by Highland Europe and One Peak Partners. Other investors include Bpifrance, through their Large Venture fund and Revaia. Since then, Deepki has carried out strategic acquisitions including that of its principal UK-based competitor, Fabriq, and complementary SaaS solution, Nooco.